Sustainable

Fiscal Policies

On November 1, 2007 Theresa Acerro and

Jackie Lancaster gave this presentation to the Chula Vista city council:

Click here for a Video of

just our presentation.

In light of the current General Fund Budget

deficit we urged the City council to adopt a policy to follow more sustainable

fiscal practices in the future.

1.

Greater Attention needs to be given to

the Jobs/Housing

Jurisdiction |

1990 |

2000 |

2004 |

%Change 1990-2000 |

% Change 2000-2004 |

City of Chula VistaTotal Population Total Housing Units Total Employment*** |

135,160** 49,846** 60,740 |

174,319** 59,333** 70,540 |

209,133* 70,067* 74,180 |

29% 19% 16% |

17% 15% 5% |

As this section

of a county

wide chart from the Otay Valley Watershed Plan shows the city of Chula

Vista in its rush to develop the eastern territories permitted the construction

of way more houses than job/income producing commercial and industrial

projects. We are now suffering the consequences of this unsustainable growth policy.

Not only are we are a bedroom community with most people commuting to work by

car, but we do not have the money to provide the services all these residents

are demanding. Since

Proposition 13, property taxes pay an increasingly smaller part of the

service needs of residents each year. In California residential housing

typically provides about 14% less income than it requires. Throughout the years

developments in the east have been required to provide Public Facilities

Financing Plans (PFFP). If

past councils had paid attention to these documents they would have seen that

after 5 years or so none of the housing developments would pay all their

service needs. This is now becoming clear. We need to take action to make

sure it does not continue happening. What is needed is a focus on jobs/income

producing development until we have a sustainable, dependable income stream to

provide the services our residents require and expect.

As this section

of a county

wide chart from the Otay Valley Watershed Plan shows the city of Chula

Vista in its rush to develop the eastern territories permitted the construction

of way more houses than job/income producing commercial and industrial

projects. We are now suffering the consequences of this unsustainable growth policy.

Not only are we are a bedroom community with most people commuting to work by

car, but we do not have the money to provide the services all these residents

are demanding. Since

Proposition 13, property taxes pay an increasingly smaller part of the

service needs of residents each year. In California residential housing

typically provides about 14% less income than it requires. Throughout the years

developments in the east have been required to provide Public Facilities

Financing Plans (PFFP). If

past councils had paid attention to these documents they would have seen that

after 5 years or so none of the housing developments would pay all their

service needs. This is now becoming clear. We need to take action to make

sure it does not continue happening. What is needed is a focus on jobs/income

producing development until we have a sustainable, dependable income stream to

provide the services our residents require and expect.

2.

Over Dependence on Unsustainable Development Fees must end:

(Mr. Van Eenoo pointed out that this graphic implied

development fees were mixed with General Fund revenue. He stated this was not

done, because it is against the law. We believe him that the city keeps this

money separate, but our point is that councils have been spending the

development fees as though they were regular, dependable General Fund revenues.) Development fees

by law can only be spent on what they were collected for and should be confined

to the project they were collected for. The city has had the practice of

putting all these fees in one big pot and then spending without a direct

correspondence between fees collected and needed facilities. This caught up

with the city when large amounts of development fees were expended on the new

police station and civic center at the same time the housing market slowed

down. The Rancho Del Rey Library is not likely to get built for some time, even

though theoretically fees were collected for it. This problem needs to be

avoided by focusing on needed services and facilities first instead of

considering all income available for any desired use as was apparently done in

the past. This crisis cannot be blamed on a drop in development fees. Although

our budget director keeps implying this is the problem.

(Mr. Van Eenoo pointed out that this graphic implied

development fees were mixed with General Fund revenue. He stated this was not

done, because it is against the law. We believe him that the city keeps this

money separate, but our point is that councils have been spending the

development fees as though they were regular, dependable General Fund revenues.) Development fees

by law can only be spent on what they were collected for and should be confined

to the project they were collected for. The city has had the practice of

putting all these fees in one big pot and then spending without a direct

correspondence between fees collected and needed facilities. This caught up

with the city when large amounts of development fees were expended on the new

police station and civic center at the same time the housing market slowed

down. The Rancho Del Rey Library is not likely to get built for some time, even

though theoretically fees were collected for it. This problem needs to be

avoided by focusing on needed services and facilities first instead of

considering all income available for any desired use as was apparently done in

the past. This crisis cannot be blamed on a drop in development fees. Although

our budget director keeps implying this is the problem. ![]() The problem is the way the development fees

were spent over the years when housing was booming and

a lack of planning for future slumps. Development fees are one time income

meant to be spent on one-time expenses. They were never intended to be a

continuous source of income to provide ongoing services and maintenance. Unfortunately

this is how the city spent them as our City Manager told a Voice of San Diego

reporter on November 1, 2007. (When fees were not enough they borrowed

money, which made the situation even worse. The developers may pay for the fire

station but the city must put up millions to stock and staff it on an ongoing

basis.)

The problem is the way the development fees

were spent over the years when housing was booming and

a lack of planning for future slumps. Development fees are one time income

meant to be spent on one-time expenses. They were never intended to be a

continuous source of income to provide ongoing services and maintenance. Unfortunately

this is how the city spent them as our City Manager told a Voice of San Diego

reporter on November 1, 2007. (When fees were not enough they borrowed

money, which made the situation even worse. The developers may pay for the fire

station but the city must put up millions to stock and staff it on an ongoing

basis.)

The city started deficit spending in 2004 when they started

to use reserves to make up for the difference in expenditures and revenue. Now

they don’t have the reserves to see them through this bad time. The city needs

to start relying on dependable revenue streams.

3.

The Fiscal Irresponsibility of Building Housing in

Redevelopment Areas needs to be paid attention to.

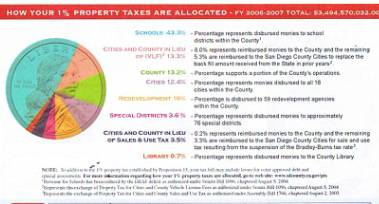

In Redevelopment

areas all increases in property tax go to the Redevelopment Agency as Tax

Increment. By law this money cannot be spent on any General Fund expense

(shown in graphic as police, fire, maintenance and libraries). When residential

housing is built in a Redevelopment area even if development fees are high

enough to get the project built with adequate facilities and services, there is

zero new money to provide ongoing fire, police, library, parks & recreation

and other General Fund services to those homes for the years they are in a

Redevelopment area. Instead of a 14% deficit there is a 100% deficit in money

to provide on-going services. Our Budget Director confirmed this at the SWCVCA

meeting on 10/22/07.

In Redevelopment

areas all increases in property tax go to the Redevelopment Agency as Tax

Increment. By law this money cannot be spent on any General Fund expense

(shown in graphic as police, fire, maintenance and libraries). When residential

housing is built in a Redevelopment area even if development fees are high

enough to get the project built with adequate facilities and services, there is

zero new money to provide ongoing fire, police, library, parks & recreation

and other General Fund services to those homes for the years they are in a

Redevelopment area. Instead of a 14% deficit there is a 100% deficit in money

to provide on-going services. Our Budget Director confirmed this at the SWCVCA

meeting on 10/22/07.![]()

On top of this

the Educational

Revenue Augmentation Fund (ERAF) requires the city and county to take money

from other tax revenues to reimburse the schools the difference between the 20%

or less they get from the RDA and the 55% they are legally entitled to. Financially

the city loses a lot of money by allowing housing to be built in a

redevelopment area.

Commercial

and Industrial properties in Redevelopment areas also do not pay added property

taxes to the city, but they usually demand way less services than residential

and provide other taxes such as sales taxes, business license fees, TOT, etc.

so the city sometimes actually gains. Except, of course the mandatory payments

to the ERAF, which gets 14% of all property tax money and leaves the city with

only 14.7% this year in Chula Vista. The above graph is specific to Chula Vista

and is from Mr. Eenoo’s presentation. The chart below shows the countywide

distribution of tax dollars and was included in this year’s property tax bill:

Commercial

and Industrial properties in Redevelopment areas also do not pay added property

taxes to the city, but they usually demand way less services than residential

and provide other taxes such as sales taxes, business license fees, TOT, etc.

so the city sometimes actually gains. Except, of course the mandatory payments

to the ERAF, which gets 14% of all property tax money and leaves the city with

only 14.7% this year in Chula Vista. The above graph is specific to Chula Vista

and is from Mr. Eenoo’s presentation. The chart below shows the countywide

distribution of tax dollars and was included in this year’s property tax bill:

Note that in 2004 the redevelopment

agencies got 8% of the property tax revenue. They now get 10%.

When cities grow

the result is higher crime rates and higher taxes. No one wants cuts in

services that will compromise our public safety and quality of life, but

hopefully no one will accept higher taxes either until the city becomes more

fiscally responsible.

The council’s reaction to our

presentation clearly illustrated the problem Chula Vista is facing:

While Councilman

Rudy Ramirez showed that he understood the point that the city must start

focusing on real economic development, which will increase the city’s revenues

in a sustainable, dependable manner ![]() ,

Mayor Cox and Councilman Rindone just did not get it.

,

Mayor Cox and Councilman Rindone just did not get it. ![]()

The comments of

Redevelopment Manager Eric Crocket ![]() were as irrelevant as they were inaccurate.

Zero dollars from property tax go to the state (See graphic from tax bill above).

The graphic of the money flying away from General Fund services very accurately

portrays how Redevelopment gets money that should go to the city’s

General Fund, libraries, special districts, and the County, which provide

services to us locally. As Issue One shows (after

20% set aside to affordable housing (49% of which is spent on administration

costs) and 20% to schools, which by law should have gotten 55%) 53% of the

redevelopment budget in Chula Vista goes to debt service and 39% to

administration. In other words Redevelopment essentially supports itself and

short changes the public. Since Proposition 13 an inadequate amount of

property tax money is provided to fund needed services. Housing does NOT pay

for its needs no matter where it is built. Cities must

develop other

sources of income in order to provide services and remain solvent.

were as irrelevant as they were inaccurate.

Zero dollars from property tax go to the state (See graphic from tax bill above).

The graphic of the money flying away from General Fund services very accurately

portrays how Redevelopment gets money that should go to the city’s

General Fund, libraries, special districts, and the County, which provide

services to us locally. As Issue One shows (after

20% set aside to affordable housing (49% of which is spent on administration

costs) and 20% to schools, which by law should have gotten 55%) 53% of the

redevelopment budget in Chula Vista goes to debt service and 39% to

administration. In other words Redevelopment essentially supports itself and

short changes the public. Since Proposition 13 an inadequate amount of

property tax money is provided to fund needed services. Housing does NOT pay

for its needs no matter where it is built. Cities must

develop other

sources of income in order to provide services and remain solvent.